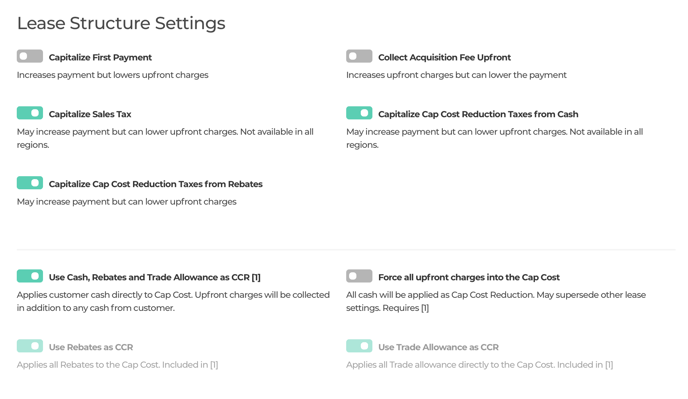

Lease Structuring Settings Ways to set up your leases to fit your business and advertising Alex Snyder

Leases are sophisticated beasts that can vary based on state and lender rules. The switches below are powerful. We recommend testing your settings before sending anything to a customer.

CCR = Capitalized Cost Reduction

Capitalize First Payment

Forces first payment into cap cost regardless of available cash. Select this if

you are trying to show leases with 0 upfront charges at the expense of have

higher payments and potentially higher taxes

Collect Acquisition Fee Upfront

Forces Acq fee as a fee that is due at signing. Select this to show lower

payments at the expense of higher upfront costs. Some lenders don't allow

this.

Capitalize Sales Tax

Regions that have a tax based on price or cap cost usually allow that sales to

be financed as part of the cap cost. Doing this can lower the upfront charges

significantly but will also increase the payment. The functionality will depend on

customer/dealer zip code. May result in the customer paying a finance charge on

the taxes.

Capitalize Cap Cost Reduction Taxes from Cash

Some areas charge tax on any cash used to lower the cap cost. Doing this will

lower the upfront charges but slightly increase the payment. May result in the

customer paying a finance charge on the taxes. Since this will be applicable in

cases where the customer is putting extra cash into the lease, it's recommended

to not do this so the customer isn't financing the tax.

Capitalize Cap Cost Reduction Taxes from Rebates

Same as previous but specifically for capitalized cap cost reduction coming from rebates.

Use Cash, Rebates and Trade Allowance as CCR

Selecting this is the same as selecting #2 in the old dropdown. Will collect

upfront regardless of available cash. For example, a lease with $1234 of upfront

charges and $1000 down will have a cash due at signing of $2234. This is the

most common way dealers present leases. Usually will lower the payment while

increasing the upfront charges.

Force all upfront charges into the Cap Cost

Same as selecting the old #3 in the old dropdown. Calculates all upfront charges

regardless of available cash, then capitalizes them. All available cash is then

applied/taxed as CCR. Not usually recommended. Not available if 'Force all

upfront charges into the Cap Cost' is selected. All fees marked as upfront will

be capped.

Use Rebates as CCR

Uses all applied rebates as CCR. No rebates will be used to cover upfront

charges first. Auto selected if 'Use Cash, Rebates and Trade Allowance as CCR'

is selected. Not all rebates can be used this way.

Use Trade Allowance as CCR

Uses all trade allowance as CCR. No trade allowance will be used to cover

upfront charges first. Auto selected if 'Use Cash, Rebates and Trade Allowance

as CCR' is selected.