Ideas for lease structuring Use these settings to match up to the way you do leases Alex Snyder

NOTES: Custom fees have their own cap/upfront settings that work independently of these settings. Noted where needed

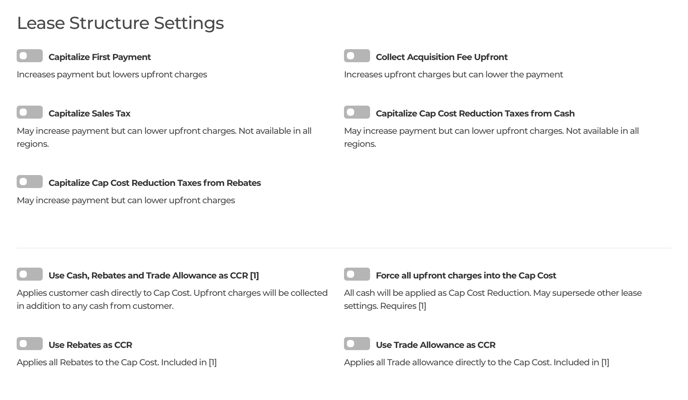

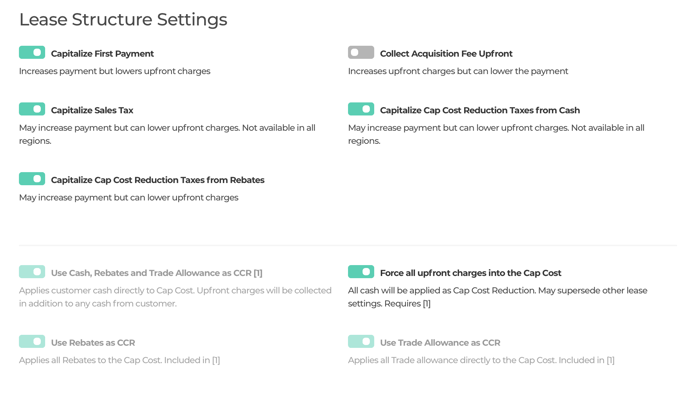

1. DEFAULTS

#1. DEFAULTS

- Capitalize First Payment - OFF

- Collect Acquisition Fee Upfront - OFF

- Capitalize Sales Tax - OFF

- Capitalize Cap Cost Reduction Taxes from Cash - OFF

- Capitalize Cap Cost Reduction Taxes from Rebates - OFF

- Use Cash, Rebates and Trade Allowance as CCR - OFF

- Force all upfront charges into the Cap Cost - OFF

- Use Rebates as CCR - OFF

- Use Trade Allowance as CCR - OFF

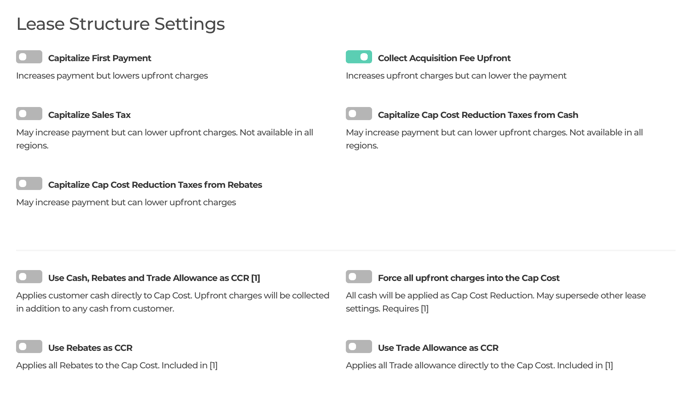

2. How to best use available cash

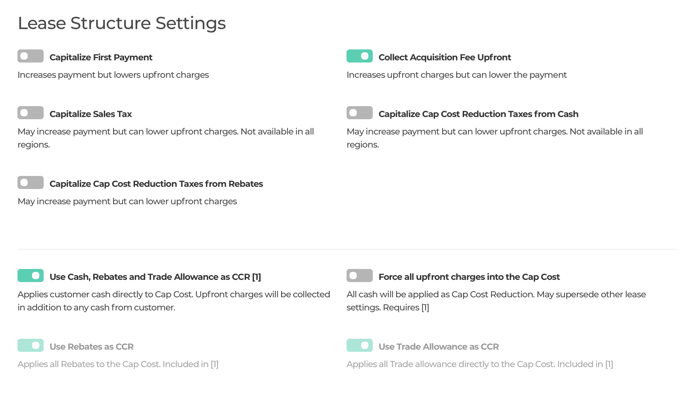

#2 HOW TO best use available cash (Recommended settings)

Customer cash will be considered Total Out of Pocket. Cash will be used to cover

inception fees first. Remaining inception fees will be capitalized, extra cash

will be applied as CCR. These are recommended settings as they usually have the

lowest taxes and financing charges when considering available cash. These

settings can be used to create $0 Down leases. Depending on lender rules, Acq

may still be capped even though cash is available to cover it.

- Capitalize First Payment - OFF

- Collect Acquisition Fee Upfront - ON

- Capitalize Sales Tax - OFF

- Capitalize Cap Cost Reduction Taxes from Cash - OFF

- Capitalize Cap Cost Reduction Taxes from Rebates - OFF

- Use Cash, Rebates and Trade Allowance as CCR - OFF

- Force all upfront charges into the Cap Cost - OFF

- Use Rebates as CCR - OFF

- Use Trade Allowance as CCR - OFF

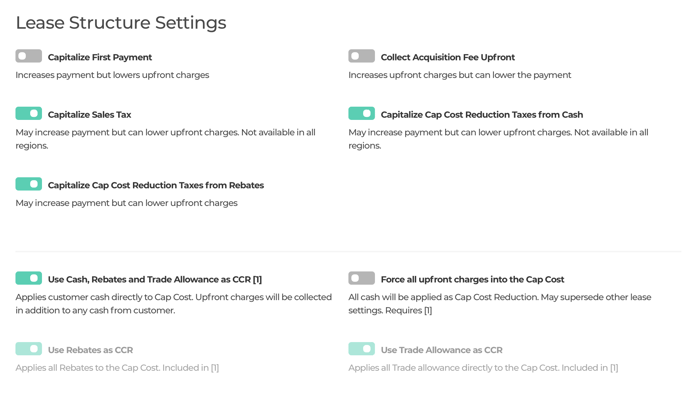

3. How to get a first payment only due at signing lease

#3 HOW TO get a first payment only due at signing lease:

Only first payment will be required upfront, customer cash will be collected in

addition to first payment

- Capitalize First Payment - OFF

- Collect Acquisition Fee Upfront - OFF

- Capitalize Sales Tax - ON

- Capitalize Cap Cost Reduction Taxes from Cash - ON

- Capitalize Cap Cost Reduction Taxes from Rebates - ON

- Use Cash, Rebates and Trade Allowance as CCR - ON

- Force all upfront charges into the Cap Cost - OFF

- Use Rebates as CCR - ON (forced)

- Use Trade Allowance as CCR - ON (forced)

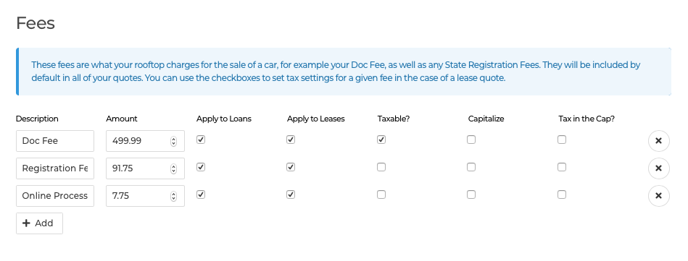

- ALSO: Mark all fees as capitalized in fee settings

4. How to force $0 due at signing leases

#4 HOW TO force $0 due at signing leases:

Will force cap all upfront charges. #2 is usually recommended over this as it

will apply cash more advantageously when it is available

- Capitalize First Payment - ON

- Collect Acquisition Fee Upfront - OFF

- Capitalize Sales Tax - ON

- Capitalize Cap Cost Reduction Taxes from Cash - ON

- Capitalize Cap Cost Reduction Taxes from Rebates - ON

- Use Cash, Rebates and Trade Allowance as CCR - ON (forced)

- Force all upfront charges into the Cap Cost - ON

- Use Rebates as CCR - ON (forced)

- Use Trade Allowance as CCR - ON (forced)

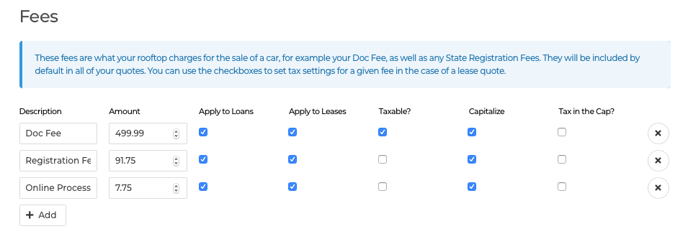

5. How to show the lowest possible legit payments

#5 HOW TO show lowest possible legit payments:

These settings will show the lowest possible payments but the highest Due at

Signing amounts. Useful for running ads with payments that include fees and

taxes.

- Capitalize First Payment - OFF

- Collect Acquisition Fee Upfront - ON

- Capitalize Sales Tax - OFF

- Capitalize Cap Cost Reduction Taxes from Cash - OFF

- Capitalize Cap Cost Reduction Taxes from Rebates - OFF

- Use Cash, Rebates and Trade Allowance as CCR - ON

- Force all upfront charges into the Cap Cost - OFF

- Use Rebates as CCR - ON (forced)

- Use Trade Allowance as CCR - ON (forced)

- ALSO: Make sure all fees are not capitalized in fee settings

Did this answer your question?

Did this answer your question?