How do I bump rates and money factors? Controlling target paid reserve for more F&I or back-end profits Alex Snyder

Profit on the back-end is too important to not take control of. Right?

You can choose to attack your paid reserve one of two ways:

- Shoot for a dollar amount

- Shoot for a bump in rate (the traditional way)

When you're logged in as a dealer with the proper credentials you can access the PROFIT box on any vehicle details page. Once there you have a drop-down box to select how you want to raise your paid reserve from the lenders.

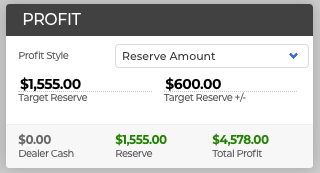

Profit Style = Reserve Amount

This is when you can shoot for a specific dollar amount ($1,555 in this case) wiggle room of $600 in either direction. This means you'll take a paid reserve up to $2,155 or as little as $955, but you're aiming for $1,555.

Total profit is the combination of front-end profit (the difference between invoice or cost and the selling price), any applicable dealer cash on new cars, and the reserve.

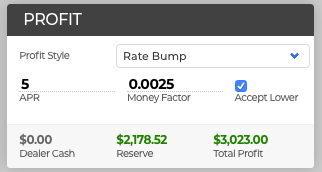

Profit Style = Rate Bump

You're probably an expert in how this works because you've been doing this your entire career. In the case above we're getting crazy and asking for 5 points of rate markup on the loan's APR. We're also looking to raise the lease's Money Factor by 0.0025. The Accept Lower checkbox is a way of saying you will take the maximum bump up to the bumps you've put in. We HIGHLY advise checking this off as you may not get programs back when shooting for the stars with a 5 point rate bump in this example.

Total profit is the combination of front-end profit (the difference between invoice or cost and the selling price), any applicable dealer cash on new cars, and the reserve.

Did this answer your question?